The Future of Loyalty in the Data Era

Increasingly sophisticated and personalized customer experiences...

Read moreInsights

Go to the BlogIn primo piano

The Future of Loyalty in the Data Era

Increasingly sophisticated and personalized customer experiences...

Read moreEnterprise Solutions

Recent Publications

Whitepaper

How artificial intelligence is revolutionising customer relations

Download the WhitepaperExtra

A new horizon for CRM

Automation and integration: apps

100% digital, fast and paper free processes

A new standard based on AI and HubSpot

Integrated and optimized e-commerce management with HubSpot

Exelab World

Where ideas and innovation meet

Texts to meet tomorrow's challenges

Discover our insights: visit the blog

Latest updates

Insights

Go to the BlogIn primo piano

The Future of Loyalty in the Data Era

Increasingly sophisticated and personalized customer experiences...

Read moreAbout Us

Innovation, excellence, technology: at Exelab we design the future of business processes

Exelab and The Client Group: an operational synergy to raise customer experience to the highest level

Careers

We are always looking for talent ready to make their mark: explore our opportunities

We're hiring!Exelab is an official partner of

Events

Discover our EventsMost Recent Event

Solutions

Enterprise Technology

HubSpot

Discover

About

Solutions

Exelab Solutions

Insights

Go to the BlogIn primo piano

The Future of Loyalty in the Data Era

Increasingly sophisticated and personalized customer experiences...

Read moreEnterprise Technology

Enterprise Solutions

Recent Publications

Whitepaper

How artificial intelligence is revolutionising customer relations

Download the WhitepaperHubSpot

Extra

A new horizon for CRM

Automation and integration: apps

Discover

100% digital, fast and paper free processes

A new standard based on AI and HubSpot

Integrated and optimized e-commerce management with HubSpot

Exelab World

Where ideas and innovation meet

Texts to meet tomorrow's challenges

Discover our insights: visit the blog

Latest updates

Insights

Go to the BlogIn primo piano

The Future of Loyalty in the Data Era

Increasingly sophisticated and personalized customer experiences...

Read moreAbout

About Us

Innovation, excellence, technology: at Exelab we design the future of business processes

Exelab and The Client Group: an operational synergy to raise customer experience to the highest level

Careers

We are always looking for talent ready to make their mark: explore our opportunities

We're hiring!Exelab is an official partner of

Events

Discover our EventsMost Recent Event

As the first signs of emergence from the Covid-19 crisis became evident, the early part of 2022 had businesses hoping for the reestablishment of economic and social balances to pre-pandemic levels.

Today, Western companies are clashing with significant political-economic events; events that have caught businesses off guard, also due to this initial optimism.

The impact on consumer habits and market trends cannot be ignored: faced with the need to respond, decision-making bodies of large organizations, particularly CIOs, CFOs, and CMOs across different sectors, are setting counter-strategies that seem to have a lot in common.

When widespread optimism meets negative external events, reactions related to a positive confirmation bias are easy to notice.

This is the psychological reaction where there's a tendency to select almost exclusively positive information, ignoring the objectivity of data and indicators related to an assumption.

In the report "The Chief Marketing Officer, Third Quarter 2022," Gartner identified a confirmation bias shared by managers and VP marketing throughout 2022, whereby predictions about economic recovery dynamics (especially for sectors most affected by the pandemic) were partly skewed.

Specifically, a representative sample of large global companies reported increasing budgets and resources for marketing operations.

.png?width=1820&height=1020&name=1%20(2).png)

Percentage of Revenue allocated to the Marketing budget from 2018 to this year.

From: The Chief Marketing Officer, Third Quarter 2022, Gartner

The lack of agile planning resulted in a resource allocation that had to confront the current:

Statistics largely attributable to 3 main events:

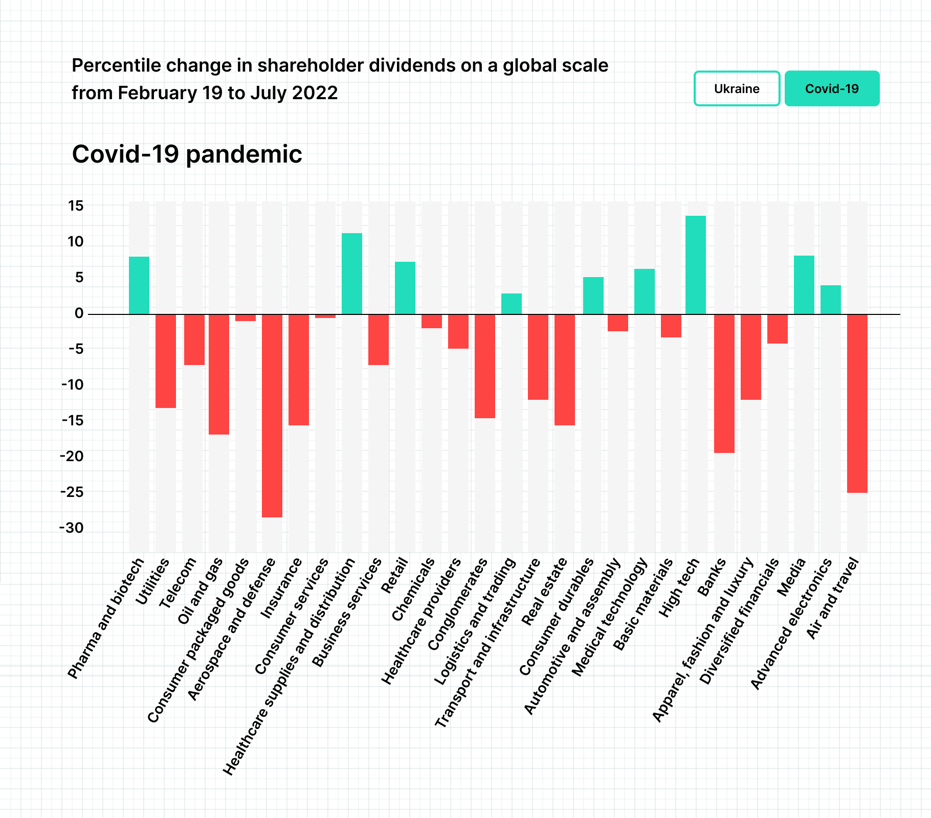

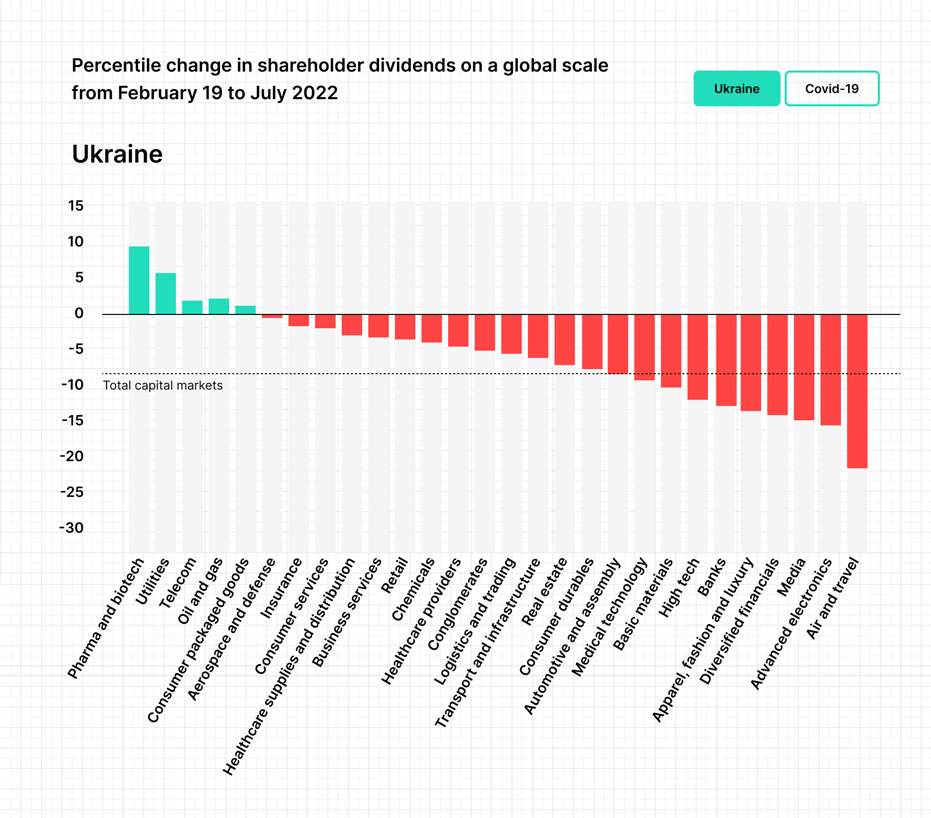

The two major events of the last three years, Covid and the Ukrainian-Russian conflict, also had significant consequences on shareholders' dividends in almost all sectors:

Percentile change in shareholder dividends on a global scale from February 19 to July 2022

Percentile change in shareholder dividends on a global scale from February 19 to July 2022

From: McKinsey, "A defining moment: How Europe’s CEOs can build resilience to grow in today’s economic maelstrom," 2022

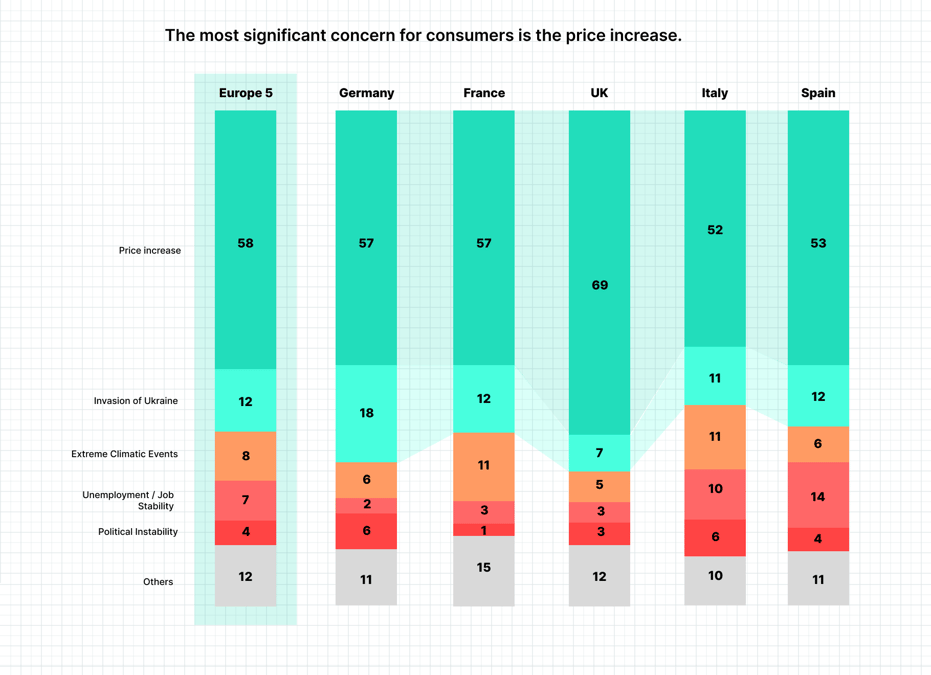

The most significant concern for consumers is the price increase.

From: European Consumer Pulse Survey, 2022, McKinsey

In interviews with CMOs and VP marketing from various sectors, Gartner gathered valuable feedback to understand what countermeasures companies are adopting in the latter part of 2022:

"Digital tools and engagement will not only remain over time but will increasingly become pivotal in deciphering the uncertainty inherent in many historical phases. This is not just about the client side but especially about how work is done within an organization." (Insurance sector)

"The pandemic reminded us that we had lost sight of the fact that every plan, to succeed, must be built to change and adapt quickly to conditions." (Healthcare sector)

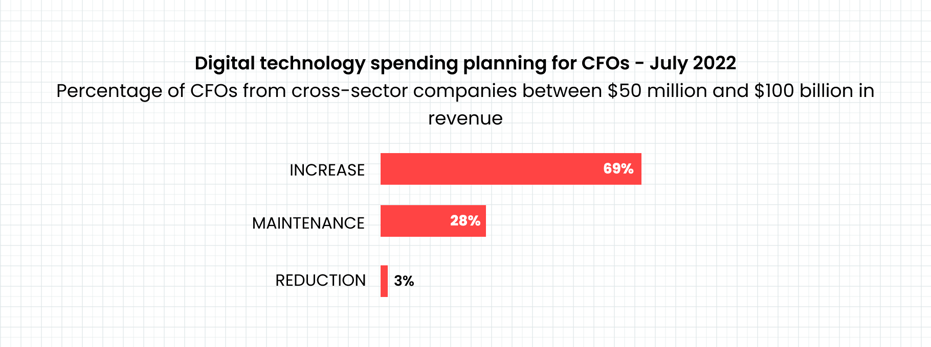

Digital technology spending planning for CFOs - July 2022

Percentage of CFOs from cross-sector companies between $50 million and $100 billion in revenue

Earlier shifts in budget allocation were focused on technological innovation by the end of Q2 this year (from Gartner, "9 C-Suite Actions to Emerge Stronger During Recession," 2022).

"The decline in demand inevitably leads us to reallocate the budget towards more traceable performance marketing" (Retail sector)

"We will plan on agile models rather than holistic plans as done in the past" and "We are increasing marketing investments rather than limiting expenses. We see this period as an opportunity to make our voice heard even more and get a larger market share" (respectively for insurance and finance).

In summary: companies aim to achieve more careful tracking of budget plans, along with strengthening marketing operations with technology and digitization, also to shape more flexible and agile organizations.

Embarking on a transformation towards more agile organizations and more efficient technological ecosystems does not strictly mean comparing different technological solutions and choosing the cheapest.

Making the organization flexible and the processes traceable means, for example, studying the business in relation to questions like:

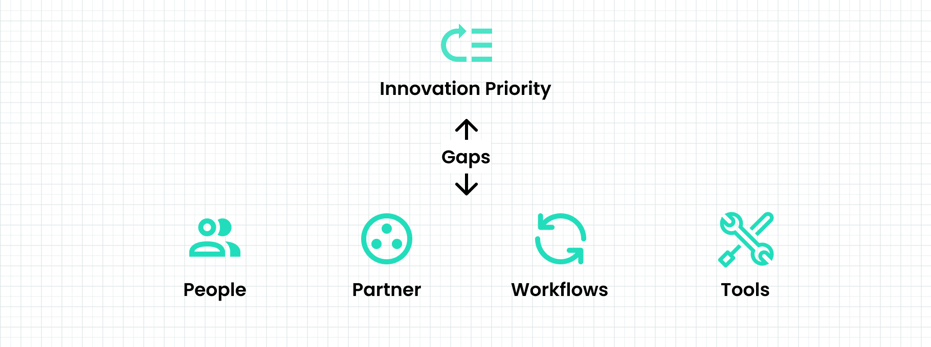

Following analytical procedures like Need Gap Analysis, useful to determine the discrepancy between current processes and expected results.

Innovation Priority / Gaps

People, Partner, Workflows, Tools

From: Gartner, "The Chief Marketing Officer, Third Quarter 2022"

What companies can do today to adapt to unstable markets is to start understanding if and how digitization and process monitoring can take shape.

Finally, knowing that replacing, maintaining, and/or modifying the current tech stack are operations with a significant impact on the organization, ROI variables, time, resources, and people involved will now have to guide this true evolutionary step more than ever.