The Future of Loyalty in the Data Era

Increasingly sophisticated and personalized customer experiences...

Read moreInsights

Go to the BlogIn primo piano

The Future of Loyalty in the Data Era

Increasingly sophisticated and personalized customer experiences...

Read moreEnterprise Solutions

Recent Publications

Whitepaper

How artificial intelligence is revolutionising customer relations

Download the WhitepaperExtra

A new horizon for CRM

Automation and integration: apps

100% digital, fast and paper free processes

A new standard based on AI and HubSpot

Integrated and optimized e-commerce management with HubSpot

Exelab World

Where ideas and innovation meet

Texts to meet tomorrow's challenges

Discover our insights: visit the blog

Latest updates

Insights

Go to the BlogIn primo piano

The Future of Loyalty in the Data Era

Increasingly sophisticated and personalized customer experiences...

Read moreAbout Us

Innovation, excellence, technology: at Exelab we design the future of business processes

Exelab and The Client Group: an operational synergy to raise customer experience to the highest level

Careers

We are always looking for talent ready to make their mark: explore our opportunities

We're hiring!Exelab is an official partner of

Events

Discover our EventsMost Recent Event

Solutions

Enterprise Technology

HubSpot

Discover

About

Solutions

Exelab Solutions

Insights

Go to the BlogIn primo piano

The Future of Loyalty in the Data Era

Increasingly sophisticated and personalized customer experiences...

Read moreEnterprise Technology

Enterprise Solutions

Recent Publications

Whitepaper

How artificial intelligence is revolutionising customer relations

Download the WhitepaperHubSpot

Extra

A new horizon for CRM

Automation and integration: apps

Discover

100% digital, fast and paper free processes

A new standard based on AI and HubSpot

Integrated and optimized e-commerce management with HubSpot

Exelab World

Where ideas and innovation meet

Texts to meet tomorrow's challenges

Discover our insights: visit the blog

Latest updates

Insights

Go to the BlogIn primo piano

The Future of Loyalty in the Data Era

Increasingly sophisticated and personalized customer experiences...

Read moreAbout

About Us

Innovation, excellence, technology: at Exelab we design the future of business processes

Exelab and The Client Group: an operational synergy to raise customer experience to the highest level

Careers

We are always looking for talent ready to make their mark: explore our opportunities

We're hiring!Exelab is an official partner of

Events

Discover our EventsMost Recent Event

%20copia.webp)

In Italy, which is witnessing a significant reduction in physical bank branches, and in Europe, already leaning towards the digitalization of banking contexts (Spain and France have digital bank customer rates of 65% and 72%)1, the investment areas of large banks are increasingly oriented towards digital transformation and technological development.

In fact, in Northern Italy, 6% of the population no longer has access to a physical branch. In the Center, the phenomenon is more limited (3.2% of the population), and in the South and the islands, citizens without access to physical counters represent 10.7% of residents.

In response to more unstable, fast-moving markets influenced by global events such as the pandemic and the conflict in Ukraine, banking contexts are accelerating the search for new business models, based on a resilient, flexible approach, and on technology to provide customer services and optimize process management.

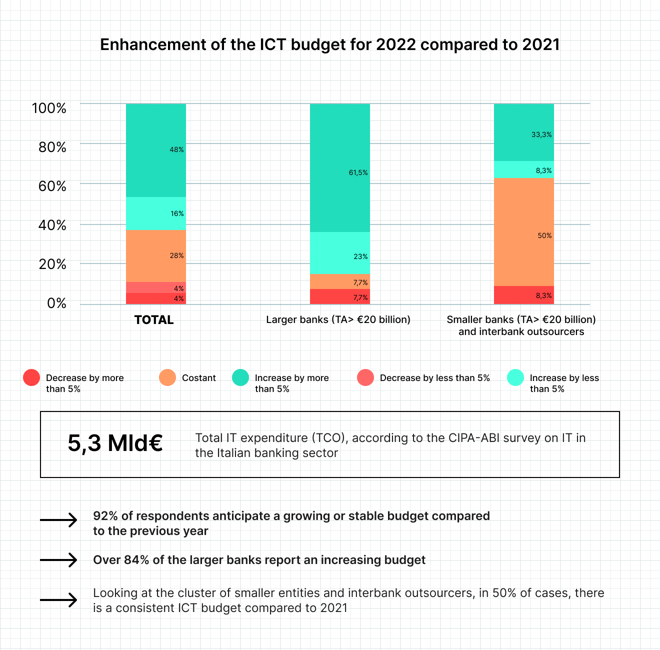

According to the latest AbiLab research “The main trends in the banking sector” (2022), major banking institutions plan to rely on increasing budgets dedicated to Information Technology (for 84% of banks with a total active balance exceeding 20 billion) or otherwise stable and promising (for 94%)2.

So, towards which technologies is the Italian banking landscape turning, and how do banks plan to remain competitive?

Starting from one of the recent global events that transformed people and markets (the COVID-19 Pandemic), it can be inferred why 52% of Italian banks place online customer onboarding in their top 10 investment priorities.

This event was a crucial driver for the digital switch that occurred in most sectors, and for the Italian banking context, this transition is happening with a vision that deeply and complementarily collaborates between technology and people.

The flexibility of business models that can benefit banking institutions stems precisely from the synergy between technology and the human, physical, and personalized approach with the client:

To approach an increasingly digitalized customer base, according to the same AbiLab report3, 58% of banks direct their investments towards predictive analytics and process automation, establishing collaborations and Joint Ventures with Fintech solutions.

In the logic of Artificial Intelligence applied to the banking context, there are various possibilities for which banks have started testing and experimentation activities to understand which AI functions could actually be developed.

Among the explored features:

AI tools hold a primary position among banking investment goals and, although only the processes related to security have 100% surpassed the aforementioned pilot phases, other features are well on their way to surpassing testing procedures.

Robotization and Business Automation systems are highly regarded (among the top 10 investment priorities) by 44% of banks nationwide, as of 20223.

Linking the logic of cooperation between technology and people, and a deep and personalized understanding of different customer segments, automation tools focusing on the customer themselves become a primary solution for growth.

For instance, CRM functionalities allow for increasingly personalized experiences in customer-facing processes and improve knowledge of user behavior. This positively impacts people's operations and, at the same time, enables more targeted and close-to-target marketing actions.

Imagining a scenario, a bank could subject clients to a survey testing their financial literacy, segment the audience accordingly, and offer different content to different groups in a marketing campaign.

Today's technological bank aims to know its customers more deeply and simplify their experience during interactions.

At the same time, it ensures that technology does not alienate customers from the institution, choosing to automate the most time-consuming and repetitive processes and dynamics that can facilitate employees, for instance, on activities subject to human error.

To urge banks to make a tangible change in this direction, an excerpt from the report issued by Banca d'Italia in 2022 is cited (related to the change in regulations on decision-making intermediaries and in the face of the digitalization and technological adoption of banks):

"Never, as in these phases of profound changes, is it essential to ensure effective dialogue with the market to understand and, if possible, anticipate the developments of technology applied to finance. [...] The regulatory framework is subject to changes that challenge paradigms consolidated over time aimed at favoring a set of rules based on the legal nature of intermediaries.

However, supervision must be able to act promptly, in the face of changes that are already taking place and have repercussions on the risk profiles of intermediaries."4

1: Banca d’Italia, 2021-2022

2: Abi Lab, 2022

3: Abi Lab, 2022

4: Abi Lab, 2022

4: Banca d’Italia, Rischi e Innovazione: l’approccio della vigilanza, 2022